9 things to look for in a rock-solid event payment processing system

Often when event professionals begin to look for event business management software, they don’t think of payment processing first. People in event management tend to prioritize tools for building event agendas and schedules, managing tasks, collecting registrations, tracking attendees and building budgets. People in venue management are all about managing event bookings and clients, tracking leads and prospects and managing proposals and invoices.

However, event payment processing can potentially make a bigger difference to your business’s bottom line than any of those other tools (as anyone who uses hotel or restaurant merchant services knows) because:

- Integrating online credit card payments with your invoicing and event registration tools can increase cash flow because customers can process payments more easily, thus you get paid sooner.

- Offering customers multiple ways to pay (credit card, check, ACH, etc.) can lead to more purchases (and more timely payments).

- Lower credit card processing fees and pricing can put money back in your pocket (whereas high fees can eat into profits).

With that said, here are nine things you should consider when shopping for an event payment system.

1. Reliable payment processors

Many online event planner and event venue management software providers (like Planning Pod as well as Eventbrite, Cvent, Xing Events, RSVPbook, Ticketbud and RegPack) integrate with one or more credit card payment processors that are responsible for running and managing credit card transactions. There are hundreds of such processors out there, but a few of the most popular and reputable include Stripe, Square and Authorize.net.

In addition, there are also specific restaurant credit card processing and hotel payment processing systems - often called point-of-sale (POS) systems - like TouchBistro, Toast, Upserve, Clover Station, Revel and Alohoa POS. Note that some of these systems offer their own merchant accounts while others integrate with external merchant processors.

While Planning Pod is not a merchant processor, we do directly integrate with payment gateways (which is very common among event management software and venue management software providers).

You would be well served to compare the processors you are considering by rating them on the following factors:

- Major credit cards accepted - Can include Visa, MasterCard, American Express and Discover.

- Time period before funds are remitted - This is how quickly the processors deposit funds in your bank account after the transactions are approved. A good rule of thumb here is less than 5 days, with 1-2 business days being optimal. Note that it often takes longer for ACH payments to fully fund in your bank account due to the nature of banking regulations and systems.

- Processing fees - These can vary from 5.5% to less than 2.35% per transaction (average tends to hover around 3%), but make sure you read the fine print and talk with a representative before signing up. Note that some merchant processors like Stripe, Square, WePay and PayPal offer fixed transaction fees, while others offer variable transaction fees based on the nature of the transaction and type of credit card used (for example, some high-benefit cards carry a higher transaction fee). You may benefit from the variable fee structure if your credit card transaction volume is high, so talk with your provider to negotiate a favorable rate.

- Handling of refunds and chargebacks - Unfortunately, these are necessary evils when running credit card and debit card payments. So make sure to ask your event payment system about how far back you can process refunds for payments and how they handle chargebacks and can assist you in cases of fraud (either “friendly” or outright).

2. Invoicing

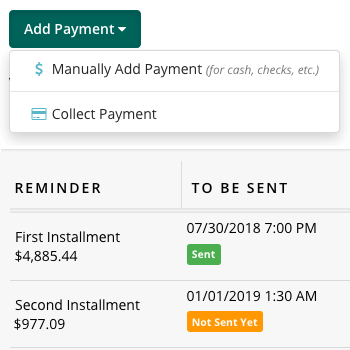

The cornerstone of any good venue or event business management system is a solid invoice generator. This tool should allow you to quickly and easily build invoices as well as send invoices to clients, and it should integrate directly with an event payment processing system. It should also allow you to input manual transactions for offline payments like cash and check payments.

Many venues and some event planners bill in installments, so an event invoicing platform should also offer the ability to set up and process installment payments; this can include payment reminders and automated payments for installments. Another big timesaver is the ability to create event invoice templates that are standard to your type of business (like event planner invoice templates, venue invoice templates, etc.).

3. Registration and Ticketing

Most people are accustomed to paying for tickets for all kinds of events online and by credit card (including concerts, fairs, festivals, conferences, fundraisers, etc.), so integrating payment processing into your event registration and online ticket sales systems is vital to maximizing attendance and revenues. Additional features that can improve your online event payment and registration processes and your services to registrants include event payment websites, online registration checkout forms, social media integrations and attendee management tools.

4. Check Payments

Not everybody pays by credit card, as there are still some people who prefer paying by check or cash. In these cases, it behooves you to look for an event payment software solution that offers a pay-by-check option and the ability to track these payments.

5. Card-in-Hand and POS Payments

If you book private or group events for restaurants or hotels, you are probably already using a hotel or restaurant payment processing service to run customer transactions. FYI, many restaurants, hotels and hospitality businesses employ two or more merchant accounts - one for their POS system and one for their event management system - to take advantage of all the payment functionality and features of each system.

When looking for an event payment processing solution, make sure that the merchant account processor is capable of running offline payments for card-in-hand transactions - either keyed in or via a card reader for chips or swipes.

6. Email Notifications

Having an event payment system that utilizes email to notify customers and attendees is very important and for two reasons. 1) You need to be able to quickly and efficiently send invoices to clients or invitations/reminders to potential attendees. 2) You need to be able to notify clients and attendees in a timely fashion that their payment has been received or their transaction has been processed.

In addition, it's a big bonus if your payment system lets you integrate with your existing email addresses or platforms (like Outlook or Gmail) so you can send out invoices and reminders via your business email addresses.

7. Reporting and Dashboards

Knowing the current status of payments and revenues is vital to any venue or event planning business, which is why it's important that your event payment system has customizable event reports and informative event dashboards. They let you know the status of things like open invoices, overdue payments, ticket sales and recent payments in a snap, allowing you to see where you stand with all event payment processing transactions and manual payments so you can make informed decisions about your business.

8. Mobile friendly and cloud based

The advantages of using Web-based software are pretty well-documented by now (like no need to maintain software on your devices, no downloads or installation, no fees for updates/upgrades, no data loss if your computer or device fails, etc.), but you should also consider an event payment system that is mobile-friendly so you can use it on any device - smartphones, tablets, laptops and desktops - anytime, anywhere.

NOTE: If you run an event venue or an event planning business, you are probably on-the-go and not at your desk very often, so mobile-friendly event invoicing software or an event payment app is a must.

9. Branding and customization

Being able to add your organization’s logo and branding to your event invoices (and event invoice templates), online credit card payment forms and other financial documents can help increase your brand awareness and add a professional touch to your transactions.

10. Integrations

Most event accounting software applications (including Quickbooks, Xero and Freshbooks) offer many features with regard to bookkeeping and expense tracking, but they often don’t provide the custom features that venues, event planners and businesses require for building detailed event invoices and collecting payments. So the event payment system you choose should be able to integrate with those other platforms so you don’t have your financial data spread across multiple programs.

Also, if you track your customer or attendee contact information, you should seek out an event payment software solution that contains an event CRM management tool or integrates with another CRM software.

Finally, if you already have a merchant processor in place for restaurant credit card processing or hotel payment processing, you may want to look for an event invoicing and payments system that has the ability to integrate with outside payment processors via a gateway - like the one provided by Authorize.net.